Given

Lisa earned $149,461.20

The Social Security maximum taxable was $68,400, and the Social Security percent was 6.2%

Find out in what month did Lisa hit the maximum taxable Social Security income.

To proof

As given in the question

In 1998, Lisa earned $149,461.20 i.e lisa annual income is $149,461.20 in 1998.

A year is consist of 12 months

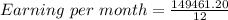

Earning per month = $12455.1

As given in the question

Social Security maximum taxable was $68,400

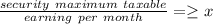

Let us assume that the month did Lisa hit the maximum taxable Social Security income be x.

Than the inequality becomes

put the value

5. 49 ( approx) ≥ x

5.49 months ≥ x

This shows the last contribution was on the june month.

Hence proved