Answer: The discounted payback period for this project is 4.3 years. If Kathleen Danceware Co. accepts projects that have a discounted payback period of three years, the company will not accept the project.

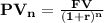

We calculate the Discounted Value of the cash flows for each year with the following formula

where

FV represents the cash flows in each of the years from year 1 to year 5

r is the firm's cost of capital at 10%

n starts from 1 for the first year ans increases sequentially until year 5

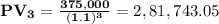

For eg, the PV of cash flows in year 3 will be

The following table gives us the Discounted cash flows and cumulative discounted cash flows. The cumulative discounted cash flows column help us determining the payback period.

Total Investment $1250000

Year Cash Flow Discounted Cash Flow at 10% Cumulative Cash Flows

1 375000 3,40,909.09 3,40,909.09

2 375000 3,09,917.36 6,50,826.45

3 375000 2,81,743.05 9,32,569.50

4 375000 2,56,130.05 11,88,699.54

5 375000 2,32,845.50 14,21,545.04

We calculate Cumulative Cash flows by adding the previous year's or years' total discounted cash flows to current year's cash flows.

For e.g.

Substituting the values we get,

We calculate the cumulative cash flows for each of the following years in the same manner

From the table, we see that the project will recover its investment between 4 and 5 years.

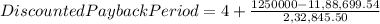

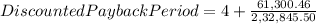

We can find the exact time as follows: