Let x be the amount of money, you fund in Fund A and y be the amount of mone yyou fund in Fund B.

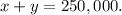

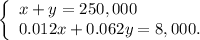

1. You have 250,000 In an IRA at the time you retire and want to invest this money into Funds A and B, then

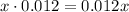

2. Fund A pays 1.2% (as a decimal 1.2% is 0.012) annually, then

is annual interest income in Fund A.

is annual interest income in Fund A.

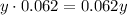

Fund B pays 6.2% (as a decimal 6.2% is 0.062) annually, then

is annual interest income in Fund B.

is annual interest income in Fund B.

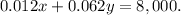

Since Fund A and Fund B produce an annual interest income of $8,000, then

3. Solve the system of equations:

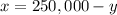

Express x from first equation

and substitute it into the second equation

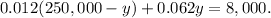

and substitute it into the second equation

Multiply this equation by 1000:

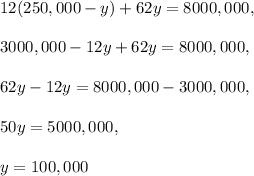

Then

Answer: you have to fund $150,000 in Fund A and $100,000 in Fund B.