Answer: The father must deposit $2493.95.

We arrive at the answer as follows:

We start off by looking at the quantum of withdrawals and calculating their present values. The last deposit will be made when the son is 15.

Year Withdrawal Period between last Present Value @ 5%

deposit & withdrawal

---------------------------------------------------------------------------------------------------------

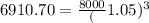

18 8000

19 8000

6581.62

6581.62

20 8000

6268.21

6268.21

21 21000

15670.52

15670.52

Total 35431.05

The total deposits at the end of year 15 should be $35431.05.

Suppose the son's 5th birthday is today. The father will make deposits of equal amounts for the next 11 years until the son's 15 years old.

We can find the value of the equal payments to be made using the Future Value of annuity formula.

![FV_(annuity) = Pmt * \left [((1+r)^(n) -1)/(r)\right ]](https://img.qammunity.org/2019/formulas/business/college/m7tuul14mb6ga026vk7t43w699kru3a5cj.png)

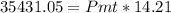

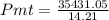

Substituting the values from the equation above we get,

![35431.05= Pmt * \left [((1.05)^(11) -1)/(0.05)\right ]](https://img.qammunity.org/2019/formulas/business/college/2nu96fw8qbthx2zwaxdj10kgabukvjr8vi.png)

![35431.05= Pmt * \left [(1.71 -1)/(0.05)\right ]](https://img.qammunity.org/2019/formulas/business/college/xrsvlhusmk58gokoxu6jsjbswpeusp8alf.png)

![35431.05= Pmt * \left [(0.71)/(0.05)\right ]](https://img.qammunity.org/2019/formulas/business/college/nu9jlh9tfk8j8y6o5r8mqi5yh3w4y9ku4z.png)