Answer:

Apr=6.2%

Explanation:

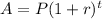

∵ Amount formula in compound interest,

Where,

P = initial value,

r = rate per period,

t = number of periods,

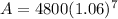

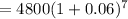

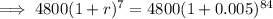

Here, the given expression that represents the amount of loan after 7 years,

By comparing,

P = $ 4800, r = 0.06, t = 7 years,

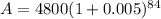

If annual rate is 0.06, then, the rate per month = 0.06/12 = 0.005

Time = 7 × 12 = 84 months,

Hence, the amount would be,

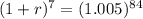

Let it is equivalent to the amount obtained in annual compound rate r for 7 years,

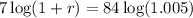

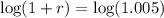

Taking log both sides,

By graphing calculator,

r = 0.06168 ≈ 0.062 = 6.2 %