Let, the companies annual income be x.

Donation budget = 5% of x.

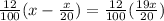

Hence, Donation =

... (1)

... (1)

Taxes represent 12% after deducting donations.

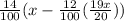

Hence, taxes is shown as

... (2)

... (2)

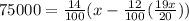

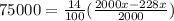

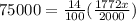

Bonus is 14% after deducting the donations and taxes.

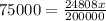

Bonus = $ 75000

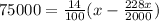

x= $ 604643.66

Annual income of the company is $ 604643.66