Answer:

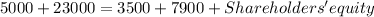

a. The value of shareholder's equity account for this firm is $16,600.

b. The net working capital for Wims Inc. is $1,500.

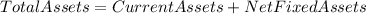

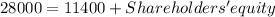

a. We start off by looking at the Accounting Identity:

Since

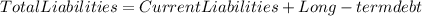

and

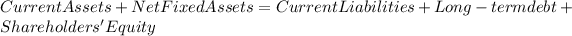

We can rewrite this accounting identity as follows:

----- (1)

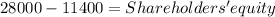

----- (1)

Plugging in the values from the question in (1) above we get,

b. The formula for Net Working Capital is: