Answer: The market price of this stock is $22.57.

In this question, we ignore last year's dividend of $1.80 as it is irrelevant.

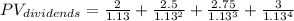

We compute the Present Value (PV) of the dividends of each of the following four years as follows:

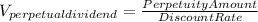

Next, we calculate the PV of dividends from the 5 year onwards. Here dividend is constant at $3.20 and is expected to be paid for ever. The PV of a perpetuity at the end of year 4 is:

The value of a perpetual dividend of $3.20 at the end of year 4 is $24.61538462

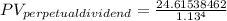

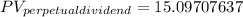

Next we find the PV of the value of perpetual dividend as follows:

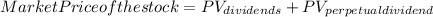

Market price of the stock = $22.57069872