Answer: Samuel company will record $20,400 as depreciation for the equipment in the adjusting entry.

We follow these steps to arrive at the answer:

We have

Cost of the equipment : $224,000

Salvage value : $20,000

Useful life : 10 years

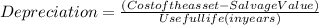

Since the company uses Straight-line method of depreciation, we can find the value of depreciation with the following formula:

In the formula above, the numerator (Cost of the asset - Salvage Value) is also known as the asset's depreciable cost.

Substituting the values from the question in the formula above, we get,