Answer

a-1 . The Present Value of the installment plan is $94.38.

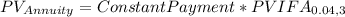

We calculate the PV of $25 for each of the three following years with the following formula:

where

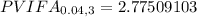

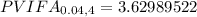

PVIFA = Present Value interest factor of an annuity of $1 at 4% for 3 years.

We can ascertain this in excel by using the syntax : =pv(0.04,3,-1).

In this syntax, 0.04 is the interest rate, 3 is number of periods and since the annuity is $1 we write 1. We need to put in -1 because otherwise, we'll get the answer as a negative number. This is because excel treats any Present Values as outflows, and records them as negative.

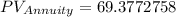

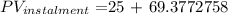

Substituting the values above in the preceding equation we get,

In order to find the Present Value of the installment plan, we need to add the down payment of $25. So,

PV of instalment = $94.38

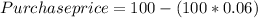

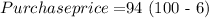

a-2. We get a 6% discount when we pay in full, so the purchase price of the product becomes:

Since the purchase price of the pay in full plan is lesser than that of the installment plan, the pay in full plan is a better option.

b-1. The Present Value of the installment plan is $90.75.

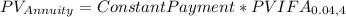

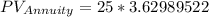

Since the first instalment falls due only after one year, we calculate the PV of $25 each of four years with the following formula:

where

PVIFA = Present Value interest factor of an annuity of $1 at 4% for 4 years.

We can ascertain this in excel by using the syntax : =pv(0.04,4,-1).

Substituting the values above in the preceding equation we get,

b-2. In this case, the PV of the pay in full plan remains at $94 while that of the instalment plan falls to $90.75. Since the PV of the Instalment plan is lower, we'll choose the instalment plan.