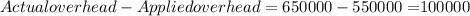

Answer: Lorein company's actual manufacturing overhead is greater than applied manufacturing overhead, so overhead has been under-applied to the extent of $100,000.

We have:

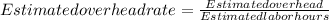

Estimated Manufacturing overhead = $650,000

Estimated Direct Labor hours = 130,000 hours

Actual Manufacturing Overhead = $650,000

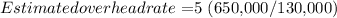

Actual Direct Labor hours = 110,000 hours.

Calculation of Estimated (Predetermined) Overhead rate:

Calculation of Applied manufacturing overhead:

![Applied overhead = Estimated overhead rate * Actual production hours [/tex</strong>]</p><p><strong>[tex] Applied overhead = $550,000 (5 * 110,000)](https://img.qammunity.org/2019/formulas/business/college/90paj1uwlzgoc8lh3hqwq5xdfuohaq5d6w.png)

Calculation of underapplied or overapplied manufacturing overhead:

Under or over applied overhead = Actual Overhead - Applied Overhead

If actual overheads are less than applied overheads, then overheads have been over-applied.

If actual overheads are more than applied overheads, then overheads have been under-applied.

In this case,