Answer: Present value of the cash flows of the company is $1,158,824.

Step-by-step explanation: Philips industries have the cash flow for $197,000. The industry needs to find the present value of the cash flow and the cash flows growth is decreasing every year by 6%.

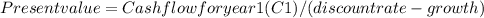

The present value of the cash flows for perpetuity with decreasing growth rate is:

where, Cash flow for the year 1 (C1) = $197,000

Discount rate (r) = 11%

Growth rate (g) = -6%

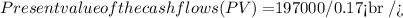

![Present value of the cash flows (PV) = $197000/[0.11 - (-0.060)]](https://img.qammunity.org/2019/formulas/business/college/stima4nhwrt6ciw6684p3dvzgxi9e5j00k.png)

Present value of the cash flows (PV) = $1,158,824

Therefore the present value of the cash flows of the company is $1,158,824.