Answer:

Mark's monthly payment is $1386.40.

Explanation:

Marc bought a new split level for $200,000. Marc put down 30%.

So, loan amount =

dollars

dollars

p = 140000

r =

n = 360

The EMI formula is :

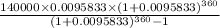

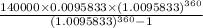

Substituting the values in the formula:

=>

= $1386.40

Hence, Mark's monthly payment is $1386.40.