wheee

Compute each option

option A: simple interest

simple interest is easy

A=I+P

A=Final amount

I=interest

P=principal (amount initially put in)

and I=PRT

P=principal

R=rate in decimal

T=time in years

so given

P=15000

R=3.2% or 0.032 in deecimal form

T=10

A=I+P

A=PRT+P

A=(15000)(0.032)(10)+15000

A=4800+15000

A=19800

Simple interst pays $19,800 in 10 years

Option B: compound interest

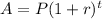

for interest compounded yearly, the formula is

where A=final amount

P=principal

r=rate in decimal form

t=time in years

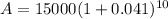

given

P=15000

r=4.1% or 0.041

t=10

use your calculator

A=22418.0872024

so after 10 years, she will have $22,418.09 in the compounded interest account

in 10 years, the investment in the simple interest account will be worth $19,800 and the investment in the compounded interest account will be worth$22,418.09