Answer: The present value of the given annuity is $ 11040.13.

Step-by-step explanation:

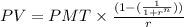

To calculate the present value for a given annuity, we use the equation:

where,

PV = present value

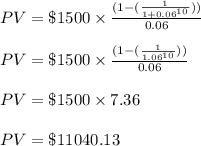

PMT = fixed annuity amount = $1500

r = rate of interest = 6 % = 0.06

n = time period = 10 years

Putting values in above equation, we get:

Hence, the present value of the given annuity is $ 11040.13.