Answer:

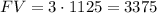

It takes 15.83 years to triple $1125 if it is invested at 7% interest.

Explanation:

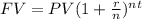

The future value (FV) of an investment of present value (PV) dollars earning interest at an annual rate of r compounded n times per year for a period of t years is:

where r/n is the interest per compounding period and nt is the number of compounding periods.

We solve for t,

When

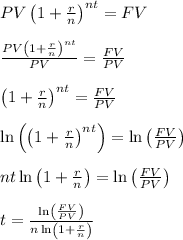

, PV = 1125, r = 7%, and n = 4, this becomes

, PV = 1125, r = 7%, and n = 4, this becomes

It takes 15.83 years to triple $1125 if it is invested at 7% interest.