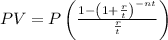

This question can be approached using the present value of annuity formula. The present value of annuity is given by

, where: PV is the present value/amount of the loan, P is the periodic (monthly in this case) payment, r is the APR, t is the number of payments in one year and n is the number of years.

Given that the

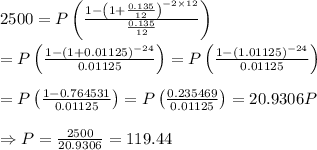

financing is for a new road bike of $2,500 and that the bike shop offers a 13.5% APR for a 24 month loan.

Thus, PV = $2,500; r = 13.5% = 0.135; t = 12 payments (since payment is made monthly); n = 2 years (i.e. 24 months)

Thus,

Therefore, his monthly payment is $119.44