This problem can be approached using the present value of annuity formula.

The present value of annuity is given by:

Where:: P is equal periodic payment, r is the annual interest rate, t is the number of payments in a year and n is the number of years for the loan to be paid.

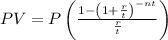

Given that a

company borrows $84,700 for new equipment and that the company agrees to make quarterly payments for 9 years at 10% per year.

Thus, P = $84,700; n = 9 years and r = 10% = 0.1.

Since the payment is to be made quarterly, thus, in one year, there will be 4 payments. i.e. t = 4.

Thus, we have: