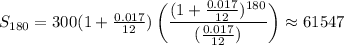

If Jerry contributes at the beginning of the month and withdraws at the end of the month, the final contribution earns 1 month's interest. The one before that earns 2 months' interest, so has a value of (1+0.017/12) times that of the last payment. In short, the sum is that of a geometric sequence with first term

a₁ = 300*(1+0.017/12)

and common ratio

r = 1+0.017/12

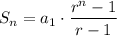

We assume Jerry contributes each month for 15 years, so a total of 180 payments. The sum is given by the formula for the sum of a geometric sequence.

Filling in your numbers, this is

If Jerry's contributions and withdrawal are at the end of the month, this balance is reduced by 1 month's interest, so is $61,460.

_____

We suppose the expected choice is $61,960. This supposition comes from the fact that a handwritten 4 is often confused with a handwritten 9. The usual simple calculation of future value uses end-of-the-month contributions by default. (a₁ = 300)