Answer:

A) Monthly Payment = $457

B) Inflation-free interest rate (month) = 0.2488%, (yearly) = 2.99%

C) Equal monthly payments = $429.75

Step-by-step explanation:

Requirement A

We know,

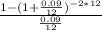

Present value of Annuity = PMT ×

Given,

Present value = $10,000

Number of period, n = 2

Interest, i = 0.09

Monthly compounded, m = 12

Therefore,

$10,000 = PMT ×

or, $10,000 = PMT × 21.8891

or, PMT = $457 (rounded to nearest whole number)

Therefore, monthly payment charged by the bank is $457.

Requirement B

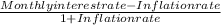

We know, Inflation-free interest rate =

Given,

Monthly interest rate = i/m = 0.09/12 = 0.0075

Monthly inflation rate = 0.5% = 0.005

Therefore,

Inflation-free interest rate =

Inflation-free interest rate = 0.0024876 or, 0.2488% per month.

Therefore, the annual inflation-free interest rate for the bank = 0.2488% × 12 = 2.99%

Requirement C

We know, equal monthly payments = Borrowed Money × (Actual payment, monthly inflation-free interest rate, number of period)

Given,

Borrowed money = $10,000

Down Payment = $2,000

monthly inflation-free interest rate = 0.2488%

number of period = 24

Equal monthly payments = $10,000 × (Actual Payment, 0.2488%, 24)

But we have to use Present value of annuity formula to find the appropriate monthly payments

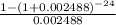

$10,000 = PMT ×

or, 10,000 = PMT × 23.2694

or, $429.75