Answer:

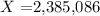

$2,385,086

Step-by-step explanation:

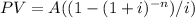

To answer this question, we need to use the present value of an ordinary annuity formula:

Where:

- A = Value of the annuity

- i = interest rate

- n = number of compounding periods

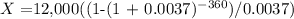

Because the interest rate is annual, it is convenient to convert it to a monthly rate.

4.5% annual rate = 0.37% monthly rate.

The number of compounding periods will be = 12 months x 30 years

= 360 months

Now, we simply plug the amounts into the formula:

You will need to have saved $2,385,086 if you plan to retire under the aforementioned circumstances.