Answer:

Interest rates and bond prices vary inversely

Step-by-step explanation:

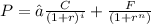

The relationship between interest rate and bond prices can be seen in the bond pricing formula. Given a series of coupon payments (C) paid over the lifetime (ranging from "1" through "i" to "n") of a bond, and given that the bond will repay the principal investment (F) at maturity, the price of the bond is

where "r" is the interest rate.

As seen in the formula, the price of the bond (P) is inversely related to the interest rate (r).

Option A is incorrect because interest rates and bond prices vary indirectly, not directly. Option C is incorrect because interest rates and bond prices are related. Option D is incorrect because vary inversely irrespective of inflation and recession.