Answer:

The effective annual rate is 26.8%

Explanation:

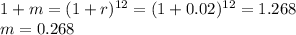

We know that the nominal annual interest rate is just the periodic(monthly) interest rate times the number of periods(12). So we have to first note the fact that we can derive the monthly compound interest rate by simply dividing the nominal annual interest rate by 12 giving us 2% as the monthly compound interest rate. Now that we have the monthly compound interest rate we can simply calculate the effective annual rate m by the formula below,

we can convert the decimal value to a convenient percentage by simply multiplying it by 100 and we will obtain our answer as 26.8% being the effective annual rate.