Answer:

Intrinsic value will be equal to $33.92

Step-by-step explanation:

We have given dividend

Growth rate = 6 5 = 0.06

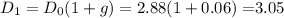

So expected dividend in the next year

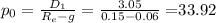

Required rate of return

We have to find the intrinsic value

Intrinsic value will be equal to

So intrinsic value will be equal to $33.92