Answer:

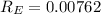

Cost of equity will be equal to 0.76 %

Step-by-step explanation:

We have given dividend just paid

Growth rate = 0.04

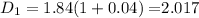

So expected dividend for the next year

Stock price

We have to find company cost of equity , that is required rate of return

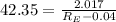

We know that stock price is given by

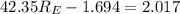

So

= 0.76 %

= 0.76 %