Answer:

1. Depreciation expense per mile = $0.25

2. (a) Depreciation expense under straight-line method; 2020 = $2,500; 2021 = $2,500

2. (b) Depreciation expense under double-declining method: 2020 = $5,200; 2021 = $4,160

2. (c) Depreciation expense per mile under the units-of-activity method: 2020 = $3,200; 2021 = $3,000

Step-by-step explanation:

Req. 1

We know,

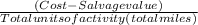

Depreciation expense per mile under the units-of-activity method

=

Given,

Delivery truck's cost = $26,000

Salvage value = $1,000

Total miles/units of activity = 100,000 miles

Depreciation expense per mile =

Depreciation expense per mile = $0.25

Req. 2 (A)

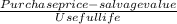

We know, Depreciation expense under straight-line method

=

Given,

Useful life = 10 years

From requirement 1, we can get,

Depreciation expense under straight-line method =

Depreciation expense = $2,500

Under the straight-line method, the depreciation expense remains same. Therefore, $2,500 is the depreciation expense for 2020 and 2021.

Req. 2 (B)

Again,

Depreciation expense rate under double declining method = (100% ÷ useful life) × 2

Depreciation expense rate = (100% ÷ 10) × 2 = 20%

Depreciation expense (Double-declining balancing method) for 2020

= $26,000 × 20% = $5,200

Depreciation expense (Double-declining balancing method) for 2021

= $(26,000 - 5,200) × 20% = $20,800 × 20% = $4,160

Under double declining method, depreciation expense is reported using the ending balance.

Req. 2 (C)

From Requirement 1, depreciation expense per mile under the units-of-activity method = $0.25

As the delivery truck drove 12,800 miles in 2020, the depreciation expense for 2020 = $0.25 × 12,800 miles = $3,200

As the delivery truck drove 12,000 miles in 2021, the depreciation expense for 2021 = $0.25 × 12,000 miles = $3,000