Answer:

False

Step-by-step explanation:

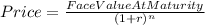

So long as interest rates remain positive, zero coupon bonds will always be sold at a discount to the face value that will be paid at maturity. The price paid for zero coupon bonds will become lower the higher the interest rates. This relationship is enforced by the valuation formula for zero coupon bonds.

Where r = discount rate

and n = the tenor of the zero coupon bond

(Note that zero coupon bonds only make one repayment at maturity).

Thus, so long as interest rate is positive, the denominator on the right hand side will be greater than 1, and dividing by a number greater than 1 will result in an answer lower than the numerator.

Therefore, so long as interest rate is positive, the price of a zero coupon bond will be lower than the face value to be paid at maturity.