Answer:

$36.98

Step-by-step explanation:

The price of the stock today is computed by discounting the FCFE for all years up to the 6th year.

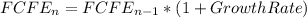

Step 1: The FCFE for each year will be computed by compounding the FCFE of the preceding year by the appropriate growth rate.

Therefore,

FCFE (year 1) = 2.75 * 1.08 = $2.97 (growth rate for the 1st 2 years is 8%)

FCFE (year 2) = 2.97 * 1.08 = $3.2076

FCFE (year 3) = 3.2076 * 1.04 = $3.3359 (growth rate for the next 3 years is 4%)

FCFE (year 4) = 3.3359 * 1.04 = $3.4693

FCFE (year 5) = 3.4693 * 1.04 = $3.6081

The FCFE for year 6 to infinity will be computed using the annuity formula to infinity since growth rate will remain constant henceforth.

FCFE (year 6 to infinity) =

=

= $46.4543.

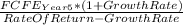

Step 2: Discounting the FCFE (using the 11% rate of return) to get the price

Price =

+

+

+ ... +

+ ... +

Price =

+

+

+

+

+

+

+

+

+

+

Price = 2.6757 + 2.6034 + 2.4392 + 2.2853 + 2.1412 + 24.8364

Price = 36.9812

= $36.98.