Answer:

weighted return = 0.0781 = 7.81%

Step-by-step explanation:

Given data:

stock cost is $50

dividend on stock is $2

cost of new stock $53

share dividend cost from 2 year now = $2

total selling cost for both stock is $54

holding period return for 1st year

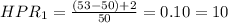

%

%

%

%

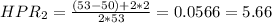

weighted return

![= [(1 +HPR_1) *(1 +HPR_2)]^(1/2) -1](https://img.qammunity.org/2020/formulas/business/college/fkb4ari14oar5wyi2s7i808eep1e0pjz0w.png)

weighted return

![= [(1+ 0.10) *(1+0.0566)]^(1/2) -1](https://img.qammunity.org/2020/formulas/business/college/ejylhlacr6mxqi2hlpcf61gvqkwawwcnpt.png)

weighted return = 0.0781 = 7.81%