Answer:

Weight of Debt that is = 24.40 %

Weight of Equity = 71.52 %

Weight of Preferred Stock = 4.07 %

Step-by-step explanation:

given data

market value Debt = $102 million

book value = $95 million

preferred stock = $ 17 million

common equity = $49 per share

shares outstanding = 6.1 million

to find out

What weights should MV Corporation use

solution

we get here first Market Value of Equity that is express as

Market Value of Equity = share Outstanding × common equity ...............1

put here value

Market Value of Equity = 6.1 million × 49

Market Value of Equity = $298.9 million

and now we get here Total Market Value that is

Total Market Value = Market Value + Market Value of Equity + Preferred Stock ...........2

put here value we get

Total Market Value = $102 million + $298.9 million + $17 million

Total Market Value = $417.9 million

so now we get

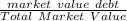

Weight of Debt that is =

Weight of Debt that is =

Weight of Debt that is = 0.2440 = 24.40 %

and

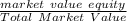

Weight of Equity =

Weight of Equity =

Weight of Equity = 0.7152 = 71.52 %

so

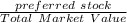

Weight of Preferred Stock =

Weight of Preferred Stock =

Weight of Preferred Stock = 0.04067 = 4.07 %