Answer:

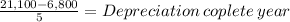

equipment value 21,100

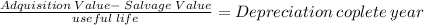

depreciation per year under striaght-line method: $2,860

Step-by-step explanation:

All incurred cost needed to leave the equipment ready for use must be capitalized:

We should incluide

cost 18,300 + 2,800 freight-in cost = 21,100

depreication per year: 2,860