Answer:

semiannual 1.42%

yearly 2.85%

Step-by-step explanation:

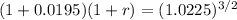

Those are annual rate so we need to determinate the 6-month rate

The annual rate times the semiannual rate will be equal to the 18 months rate

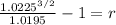

r = 0.01416296 = 1.42%

If we want to express it annually:

1.0142^2 - 1 = r = 2.85%