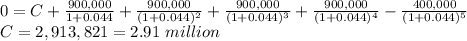

Answer:

C) $2.91 million

Step-by-step explanation:

In order for the project to be worthwhile, the sum of the present values of each year's cash flow minus the upfront cost must be equal or greater than 0. Therefore, the project ceases to be worthwhile when:

The project ceases to be worthwhile when upfront costs exceed $2.91 million