Answer:

cash 96,535 debit

discount on BP 3,465 debit

Bonds Payable 100,000 credit

Step-by-step explanation:

We need to determinate the price at which the bonds were issued:

Which is the present value of the coupon payment and maturity

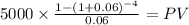

Coupon payment: 100,000 x 10% / 2 = 5,000

time 4 (2 years x 2 payment per year)

rate 0.06 (12% annual / 2 = 6% semiannual)

PV $17,325.5281

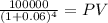

Maturity (face value) $100,000.00

time 4.00

rate 0.06

PV 79,209.37

PV c $17,325.5281

PV m $79,209.3663

Total $96,534.8944

As the bonds are issued below face value there is a discount:

100,000 - 96,535 = 3,465

the entry will recognize the cash procceds and the creation of a liaiblity

we will also use an auxiliar account for the discount on the bonds