Answer:

$98.02

Step-by-step explanation:

Data provided in the question:

Value of contract = $1,330

Maximum value = $86

Minimum value = $65

Exercise price = $78

Risk-free rate = 3%

Now,

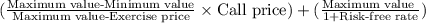

Current value of stock =

also,

a standard contract has 100 shares

thus,

Call price = Value of contract ÷ 100 shares

or

Call price = $1,330 ÷ 100 = $13.30

Thus,

Current value of stock =

or

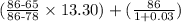

Current value of stock = ( 2.625 × $13.30 ) + $63.1068

= $98.0193 ≈ $98.02