Answer:

At discount rate of 12% it is convinient to replace the machine as the net worth is lower.

Step-by-step explanation:

We aren't given with any rate to work for we are going to assume a 12% rate of return

Current New machine

market value 86,000 227,000

expenses 37,000 9,000

useful life 10 10

salvage 13,000 86,000

F0 - (141,000)*

PV expenses (209,058)** (50,852)***

PV salvage value 4,186**** 27,690*****

Net worth (204,873) (164,162)

*227,000 cost less proceed from sale of the old machine

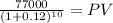

** annuity for 37,000 during 10 years discounted at 12%

C 37,000.00

time 10

rate 0.12

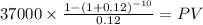

*** annuity of 9,000 during 10 years discounted at 12%

C 9,000.00

time 10

rate 0.12

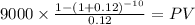

**** present value of 13,000 value of the machine in 10 year discounted at 12%

Maturity 13,000.00

time 10.00

rate 0.12000

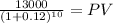

***** present value of 77,000 value of the machine in 10 year discounted at 12%

Maturity 77,000.00

time 10.00

rate 0.12000