Answer:

A) ROA = 28%

B) ROE = 20%

Step-by-step explanation:

Requirement A

We know,

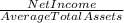

Return on Asset =

If we break the ROA formula, we can get,

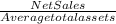

ROA =

×

×

We know, Profit margin = Net Income ÷ Net Sales; and

Asset Turnover ratio = Net sales ÷ Average total assets

Therefore, ROA = Profit margin × Asset Turnover

Given,

Profit Margin = 7% = 0.07

Asset Turnover = 4.0

Hence, Return on Asset = 0.07 × 4 = 0.28 = 28%

It shows how assets generate income over a period.

Requirement B

We know,

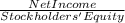

Return on Equity =

If we break the formula, ROE = (Asset ÷ Equity) × (Debt Burden) × ROA

Given,

Debt-Equity ratio = 1

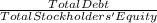

We know, Debt-equity ratio =

As debt-equity ratio is 1, debt = equity

Therefore, assets = 2 times of debt or equity

Debt Burden = Net Income ÷ (EBIT - Interest)

Debt Burden = (EBIT - Interest - Tax) ÷ (EBIT - Interest)

Debt Burden = $(21,000 - 8,200 - 8,200) ÷ $(21,000 - 8,200)

Debt Burden = $4,600 ÷ $12,800

Debt Burden = 0.359375

We have already got ROA from requirement A, ROA = 28% = 0.28

Hence, ROE = (2 ÷ 1) × 0.359375 × 0.28

ROE = 0.20125

ROE = 20%