Answer:

Explanation:

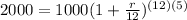

This may seem a bit tricky because we are not given enough info really to plug in and solve for the rate. We are told, however, that we are interested in doubling whatever amount we invested. So it is up to us to pick an amount for P, then double it for A(t). Let's use P = 1000 so A(t) = 2000. Filling in then:

and

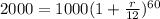

and

We need to get that r all by itself and right now it's quite buried. Begin by dividing both sides by 1000 to get

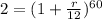

Now take the 60th root of both sides to get

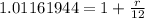

Subtract 1 from both sides to get

and multiply both sides by 12 to finally get the rate in decimal form:

and multiply both sides by 12 to finally get the rate in decimal form:

r = .13943328

To get that in a percent form, multiply it by 100:

r = 13.9%