Answer:

The Amount draw from the account after 10 years is $109,555 .

Explanation:

Given as :

The principal deposited in account = p = $50,000

The rate of interest = 8% semiannually

The time period for the amount will be in account = t = 10 years

Let The Amount draw from the account after 10 years = $A

Now, From Compound Interest method

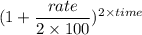

Amount = principal ×

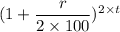

A = p ×

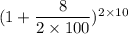

Or, A = $50,000 ×

Or, A = $50,000 ×

Or, A = $50,000 × 2.1911

Or, A = $109,555

So, The Amount draw from the account after 10 years = A = $109,555

Hence,The Amount draw from the account after 10 years is $109,555 . Answer