Answer:

It will be issued at $807

Step-by-step explanation:

The bonds will be issued at the sum of the present value of the coupon payment and maturity discounted at the market stated rate of 9%

Coupon Payment:

Coupon payment face valiue x coupon rate:

$1,000 x 6% = $60

time 10 years

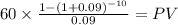

market stated rate 0.09

PV $385.0595

Maturity present value:

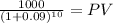

Maturity $1,000.00

time 10 years

market rate 0.09

PV 422.41

We add both values and achieve the market value of the bonds

PV coupon $ 385.0595

PV maturity $ 422.4108

Total $ 807.4703

Rounding we got the right answer as $ 807