Answer:

ABC return on equity 10.27%

XYZ return on equity 11.45%

WACC ABC same as has no debt: 10.27

WACC XYZ 10.72500%

Step-by-step explanation:

550,000 - 275,000= 275,000 debt

275,000 x 10% = 27,500 interest expense

EBIT 59,000 - 27,500 interest expense= 31,500

XYZ return on equity: 31,500 / 275,000 = 0.11454545 = 11.45%

ABC return on equity: 59,000 / 550,000 = 0.102727 = 10.27%

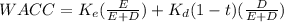

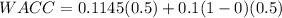

XYZ WACC:

Ke 0.1145

Equity weight 0.5

Kd 0.1

Debt Weight 0.5

t 0 (we are told to ignore taxes)

WACC 10.72500%