Answer:

A) EPS = $2.8

B) P/E ratio = 4.29 times

C) Payout ratio = 24.20%

D) Times interest earned = 9.61 times

Step-by-step explanation:

A)

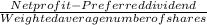

Earnings per share (EPS) is the net profit after taxes of the company divided by the number of outstanding shares. However, during the calculation of earnings per share, preferred dividend should be deducted from the net income as preference shareholders' do not get EPS.

We know, EPS =

Given,

Net profit = $94,200

Preferred dividend = $5,300

Weighted average number of shares = (beginning number of shares + ending number of shares)/2

Weighted average number of shares = $(24,400 + 39,100)/2

Weighted average number of shares = $31,750

Therefore, EPS =

EPS = $2.8

B)

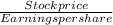

Price-earnings ratio is the market value of a stock relative to that stock's earnings per share. It is calculated as the stock price dividing the earnings per share.

We know, P/E ratio =

Given,

Current stock price = $12

From requirement A, we get EPS = $2.8

Therefore, P/E ratio =

P/E Ratio = 4.29 times

C)

When a company calculates the ratio of paying dividends to its stockholders from its net profit, it is termed as payout ratio.

We know, payout ratio =

Given,

Dividend paid to the stockholders (Including preferred dividend) = $22,800

Net income = $94,200

Hence, payout ratio =

payout ratio = 0.2420

or, payout ratio = 24.20%

D)

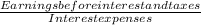

Times interest earned ratio states that how quickly or how easily a company can pay its interest to the debt holders. it is calculated as the ratio between earnings before interest and taxes and interest expenses.

We know, Times interest earned =

Given,

Earnings before interest and taxes = $94,200 + 14,200 + 28,000 = $136,400

Interest expenses = $14,200

Hence, Times interest earned = $136,400/14,200

Times interest earned = 9.61 times