Answer:

Land, $65,625 and Garage, $39,375

Step-by-step explanation:

The allocation would be done using the fair market values as basis. Fair market value is more appropriate as a basis instead of using the sizes of the building and the garage as basis.

Total fair market values = $125,000 + $200,000 + $75,000 = $400,000

Total amount paid for all assets = $210,000

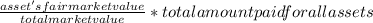

Amount allocated to each asset =

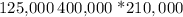

Amount allocated to land =

= $65,625

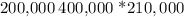

Amount allocated to warehouse =

= $105,000

Amount allocated to garage =

= $39,375