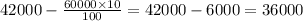

Answer:

After calculation risk amount is $36000

But in question it is given $44000

So it is false statement

Step-by-step explanation:

The amount which is paid by a taxpayer is in risk is expanded by a lot of extra plan of action obligation and diminished by the portion of misfortunes from the action.

The at-risk amount is not affected by non recourse debt. Jack's year-end at-risk amount is

But in question it is given that risk amount at the end will be $44000

So it is false statement