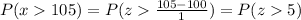

Answer:

Explanation:

We can use normal aproximation, assuming that the random variables are a lot of that means the sample size is large.

Using the normal distribution table,

P(z>5) = 0.00005

Hence, we can conclude that the probability that the stock’s price will exceed 105 after 10 days is very small.

Hope this helps!