Answer:

(I) $ 1,490.30

(II) $ 1,558.68

(III) $ 1,490.30

(IV) $ 1,369.84

Step-by-step explanation:

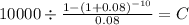

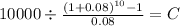

(I) French system:

PV 10,000

time 10

rate 0.08

C $ 1,490.295

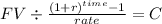

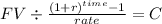

American system with payment of interest on the principal

and then, to a fund to generatethe principal at maturity

(II) 800 dollar of interest plus cuota to get 10,000 in the future

FV 10,000

time 10

rate 0.06

C $ 758.680

Total: $1,558.68

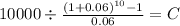

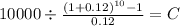

FV 10,000

time 10

rate 0.08

C $ 690.295

Total $ 1,490.30

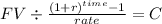

FV 10,000

time 10

rate 0.12

C $ 569.842

Total $1,369.84