Answer:

$800,000

Step-by-step explanation:

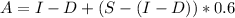

The total amount received by Ms. Jones (A) is given by the following expression:

Where 'I' is Ms. Jones initial investment, 'D' are cash distributions previously received and 'S' is the cash flow from sales.

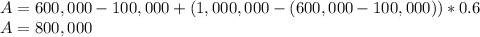

The amount received by Ms. Jones is:

She would receive $800,000.