Answer:

It will use a 3% rate

Step-by-step explanation:

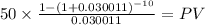

We need to solve for the discount rate which makes the coupon payment and maturity of the similar bond equal their current market value of 1,170.50

This is done using excel goal seek tool:

C 50.00 (1,000 x 5%)

time 10 years

rate 0.030011

PV $426.4860

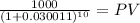

Maturity 1,000.00

time 10.00

rate 0.030011071

PV 744.01

PV c $426.4860

PV m $744.0139

Total $1,170.5000

market rate = 0.030011071 = 3%

The procedure will be to build up the formulas and link the rates to a cell.

and then, click on the total cell and use goal seek changing the rate cell