Answer:

cost of equity = 9.68%

so correct option is d. 9.68%

Step-by-step explanation:

given data

currently priced = $17.15

paid annual dividend = $1.22

dividends increasing = 2.4% annually

to find out

firm's cost of equity

solution

we get here cost of equity by apply price equation that is express as

Price = recent dividend × ( 1 + growth rate ) ÷ ( cost of equity - growth rate) .....................1

put here value we get

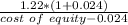

$17.15 =

solve it we get

cost of equity = 9.68%

so correct option is d. 9.68%