Answer:

after tax cost of debt = 5.08

so correct option is d. 5.08%

Step-by-step explanation:

given data

maturity = 20 years

annual coupon = 9.25%

sells price = $1,075

par value = $1,000

tax rate = 40%

to find out

component cost of debt

solution

we get here yield to maturity YTM that is express as

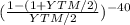

periodic interest payment PMT ×

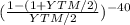

+

+

= sells price .................1

= sells price .................1

periodic interest payment PMT = par value × coupon rate ÷ 2

periodic interest payment PMT = $46.25

so from equation 1 we get

46.25 ×

+

+

= 1075

= 1075

YTM = 8.46 %

and

after tax cost of debt will be here as

after tax cost of debt = YTM ( 1- tax rate )

after tax cost of debt = 8.46% ( 1- 40% )

after tax cost of debt = 5.08

so correct option is d. 5.08%